This week I heard a presentation by a senior trader at one of the large global macro hedge funds which has been in business for nearly 20 years. He put across several insights into the way of working of those who engage in the strategy. The particular trades under discussion were in foreign exchange, in the Euro/U.S. Dollar, during last year.

Fundamental Set-Up

In FX there are three elements to the fundamentals that should be aligned for putting on a position, according to the trader. The first is valuation. In FX there are several valuation models which are commonly used though each has limitations. Purchasing power parity (PPP) for a currency pair is a value which is unobservable in markets, and is a conceptual level that actual FX rates pass through without pausing. Extreme deviation from PPP is taken as an under or over-valuation. The Economist uses the price of the ubiquitous McDonald's meal to calculate the "Big Mac Index", a guide showing how far from fair value different world currencies are. The Big Mac theory, which is based on an observable purchasing-power parity, says that exchange rates should even out the prices of Big Macs sold across the world.

The second element of the fundamentals to consider is the interest rate differential between the two countries on each side of the currency pair. This is not a static element, as the FX markets (spot rate) move with forward forward rates. So expectations of future interest rate differentials are what count. The relative growth outlooks of the two economies is what the senior trader emphasised in getting a handle on interest rate differentials. For my part I would say that the perceived prospects for medium term inflation are now taking a much bigger role in the mind of the market than hithertofor in looking at interest rate differentials.

The third fundamental element to a good FX set up for a macro trader is the policy environment. Last year presented a classic opportunity (in looking at Euro related trades) in that European politicians/central bankers commented on levels and movements in traded rates (CDSs as well as bond auctions and FX parities). Some of the great macro trades have been set up by governments attempting to talk down markets when their policy objectives clash with what the markets discount as sustainable. So last year was a classic of its type in this regard, though interest rate policy specifically was a stale issue according to the bulge-bracket macro trader. That is, changes to interest rate policy were not expected to be a driver of the market condition for the trade under consideration in the time-frame envisaged. For trades at the market level like those illustrated here, and particularly in FX it is very important to understand the market drivers at the time. The graphic below indicates what the macro trader stated were the major drivers for the €/$ level last year through the different phases.

Technical Set-Up

The technical set up for a macro trade can be about flows and positioning by the various categories of market participants (say hedgers, speculators and governments). For example, the Commitments of Traders report for listed US futures showed there were very high levels of Dollar bear positions just before the monthly employment report for July 2010 released on the 6th August last year. So the positioning in the market shifted the odds of the labour market data being bad enough to move the Euro up further versus the Dollar. That date marked an interim top for the Euro versus the Dollar.

The other form of commonly used technical set up is pattern recognition, which in its crudest form is chartism. Along with the rest of the market, the senior trader from the well-known global macro firm was onto the break in the multi-quarter uptrend for the Euro (versus the Dollar) that occurred in December 2009. The Greek debt crisis powered the multi-month fall in the Euro which lasted into the middle of 2010. The break in trend of itself is often a good entry point for a trade, but as FX markets have lots of minor reversals against the major trend traders have to have tools to identify the second and third high quality entry points as the new major trend unfolds. In the middle of January 2010 there was a good secondary entry point on such a short term reversal – as is typical the secondary entry point corresponds to a support/reversal level on the previous major trend – in this case around 1.45 on the €/$ in the period 13-15th January.

This secondary, high-quality entry point can be illustrated in another trade mentioned on this website – in Gilt futures (see here and here).

Technical Set Up for Trade in Gilt Futures Showing High-Quality Entry Point

The significance from a money management perspective is that the second entry point - as the security price accelerates away from a key support or resistance level - can be a higher conviction entry point than the first. This is because the investment hypothesis ("the market is going to go down", say) has been tested by market action and passed the test. So depending on style, the macro trader can trade in several risk units at the second entry point. In no way is the second entry point a secondary entry point!

The global macro trader also disclosed the use of a particular tool to assess sentiment – the world wide web. The fund monitored the occurrence of the phrase "quantitative easing" on the web in August, September and October to ascertain the degree of dominance in the minds of investors.

Trigger

Global macro trading is often about assessing the persistence of action by the various actors in the market drama. It was interesting that the senior macro trader said that the trigger for putting on the position was often the behaviour of the markets themselves. Note that the crucial observations are across markets, not necessarily from market action within the market under consideration. So for the €/$ last year the maturity of the Euro rally that began in June was under consideration in August by the trader because the co-movements of the S&P500 (as a proxy for global equities) and the fx rate diverged. The €/$ and the SPX had synchronised price changes for a period of some months, but over the first few trading days of August days the S&P was flat whilst the € was still appreciating against the $. For the macro trader this signalled a change of behaviour was imminent for the Euro/Dollar relationship because the S&P action signalled at least a pause in the driver for the FX rate (the slowing US economy). To quote the trader directly, "divergences between markets are the best clue for market behaviour. A correlation break that lasts for one-to-two days and can indicate a movement to follow that lasts for 2-3 months." He also stated that more than 50% of a macro trader's insight comes from understanding the message of the markets, that is the behavioural inference is key. Like many traders, including those with a macro framework, the presenting macro trader only puts capital to work if the market has already started to move in the direction he wants to play.

Sizing

Sizing of positions in macro is usually a function of risk/reward and correlation. The senior trader didn't mention correlation himself in this regard, so we'll concentrate on the potential profit and loss as the key input to position sizing. The target price and stop loss levels for positions in markets are typically placed at or near significant support and resistance levels – the difference between current price levels and these two levels gives the upside/downside ratio for the potential trade. The potential loss between current levels and the stop is used to scale the maximum position size. A loss of say 5% on a position that is 20% of the gross equity of the fund would give a portfolio level loss of 1%. If two percent loss at the fund level for a single position is the outer bound then a 3% loss to the stop would equate to a 24% of equity maximum position size. The principle is determine how much you are prepared to lose – "anything else is bad discipline, or has ego in it," admonishes the trader.

This particular macro fund also uses drawdown from peak as an additional risk limiter at the level of the individual trader. So the risk capital of the trader will be reduced if his P&L is down 5% from his own peak, and he will be out of the market for a period if he loses 10% from his peak P&L, even if he is still positive on the year.

Closing the Position

The macro trader acknowledged his belief in the concept of reflexivity – Soros' concept that positive price changes themselves impact how positively investors think about the market – such that prices can waterfall down or continue upwards way beyond most expectations. Conceptualising potential price changes and unusual market impacts helps macro traders mentally prepare for a range of market outcomes. But still an all, positions have to be closed even after exceptional profits – so what feeds into the decision making at the closing of a trade? "A position should be reviewed when a price target is hit, and should be closed for sure when a lot of the market has joined you in that position."

How do you make money in macro trading? – "You need to take risk aggressively to make money, but you need to take it well."

One of the reasons I posted this article is that the trader uses several methods I use in my own style of investing. If you run a hedge fund and would welcome input on your processes (investment, research and risk management) from my consultancy or want to persuade me to share my expertise full-time contact me on s-kerr@tiscali.co.uk

Showing posts with label strategy. Show all posts

Showing posts with label strategy. Show all posts

Friday, 28 January 2011

Tuesday, 23 November 2010

Strategy Allocation in Funds of Hedge Funds - IAM as an example

International Asset Management Limited is Investment Manager for Alternative Investment Strategies Limited, a Channel Islands Listed diversified portfolio of hedge funds. Through the Channel Islands Stock Exchange some top level information is made available.

For example, the strategy allocation as at 30 September 2010 was

Source: International Asset Management Limited

Strategy allocation at a fund of hedge funds at any one time is a function of a range of factors covering the practical and the structural:

forecast returns per strategy, fund, and underlying market;

macro factor forecasts;

correlation and variance forecasts (or at least assumptions of stability);

fund historic performance compared to peer groups and strategy index returns;

benchmark weightings, normal allocation range per strategy;

strategic biases, and tactical shifts;

cash flows, and liquidity of the underlying funds (notice period for redemption);

frictional costs (spread on fund dealing, forward pricing, spread on underlying securities, redemption fees, premium or discount on traded funds, commissions);

and illiquid security constraints (side pockets and side cars).

In addition managers have the subjective influences to cope with - there will be anchoring to the selections made previously, both by strategy and by manager. There are relationships with managers to maintain, and not a single hedge fund manager likes receiving redemption notices, even if they are described to the fund manager by the investor as "rebalancing" or "just trimming an overweight". One investor I know told me that when he tried to diversify away from his very large holding in Soros' Quantum Fund by recycling just some of his gains in the fund, Soros told him it was all or none. He could take it all out or leave it all in but could not limit his exposure at the margin.This is where rationality meets a business man overseeing a business, and it is not seen as constructive in any way by the latter.

Still and all, the fund of funds managers have to manage. In former times, when positive fund flows extended to funds of funds as well as single manager hedge funds, the job of strategy/fund allocation was a lot more simple. The new inflows could be directed to the currently preferred funds and those that were being de-emphasised could be diluted down without any need for redemption notices. That all stopped in mid 2008. Since then strategy allocation in funds of funds has required (for most funds of funds for most of the time) a redemption for every subscription. Given that there was a persistence of net redemptions as a businesss background for funds of funds well into this year it has been very challenging to activelly allocate to strategies and individual hedge funds since.

One of the advantages of the Listed (funds of) hedge funds is that they are closed-ended vehicles: the capital, if not permanent capital, is there for a finite medium-to-long-term period. This does not get over the need to redeem from one fund to subscribe to another, but at least for the Listed funds of hedge funds there has not been a wall of redemptions to cope with. And if market demand allows there may be tranches of new capital raised for quoted vehicles, to mimic the positive allocation/dilution tactic of open ended funds of funds that have positive flows.

The way that International Asset Management (IAM) has used this capacity to allocate to strategies is shown in the following table.

Strategy Allocation at Quarter End through 2010

Source: International Asset Management Limited

A couple of strategy shifts are clear from this time series. In early 2010 capital was taken from Event Driven funds and allocated to Long/Short Equity. After the first quarter CTAs and Equity managers were used as sources of capital for additions to weightings in Multi-Strategy, Credit and to raise cash.

Rather like the approach to hedge fund investing taken by the Common Fund in the U.S., it seems that IAM used a core/satellite approach to portfolio construction, as the Top 10 holdings in Alternative Investment Strategies Limited has been very stable over the last year. The funds listed at the latest data point are shown below.

The Top 10 Holdings as at 30 September

Source: International Asset Management Limited

The funds are the same as at the start of the year with only one exception (highlighted). The Top 10 funds accounted for 48.34% of the capital at the three-quarter stage.

The Top 10 Holdings of Alternative Investment Strategies Limited as at 31st December 2009

Source: International Asset Management Limited

There is a continual battle in reality and in marketing pitches about the relative contribution of the top-down (strategy allocation) and bottom-up (manager selection) in funds of hedge funds. The long list of practical difficulties given here shows that specifically since mid-2008 funds of funds have had less degrees of freedom in both of those regards than they had previously enjoyed, and that though there may be disappointment over the returns from funds of hedge funds over that period, there are also generic reasons why they have been as limited as they have been. There are other reasons for the under-performance relative to hedge fund indices and hedge fund averages, but they can be explored at another time.

Footnote: The net asset value performance of Alternative Investment Strategies since inception in December 1996 to 30 September 2010 is 146.84%, equivalent to an annualised rate of 6.75%.

ADDITIONAL: UBP ON STRATEGY ALLOCATION (from their Outlook for 2011)

Larry Morgenthal, CIO of Alternative Investments at UBP Asset Management, believes that reports of the demise of hedge funds are premature. He is quite positive about the industry and believes hedge funds remain an attractive proposition: they provide diversification benefits and they have strong alpha generation potential.

With respect to the various hedge fund strategies, Larry Morgenthal goes on to say, "Allocating between hedge fund strategies is in some respects like dating - we have had a great relationship with credit, are having an affair with long-short equity and think that emerging markets could be marriage material, while macro is like an old flame - not large in the picture now but one we expect to get back together with in the future."

ADDITIONAL TWO: Send me some examples of funds of hedge funds strategy allocations (letters) and I will post a range of them here.

For example, the strategy allocation as at 30 September 2010 was

Long/Short Equity | 30.7 |

Macro | 18.4 |

Credit | 11.4 |

Fixed Income Rel Val | 10.9 |

Event Driven | 10.3 |

Multi-Strategy | 9.4 |

Trend Followers / CTAs | 5.3 |

Cash & Receivables | 3.5 |

Fund of Funds | 0.1 |

Strategy allocation at a fund of hedge funds at any one time is a function of a range of factors covering the practical and the structural:

forecast returns per strategy, fund, and underlying market;

macro factor forecasts;

correlation and variance forecasts (or at least assumptions of stability);

fund historic performance compared to peer groups and strategy index returns;

benchmark weightings, normal allocation range per strategy;

strategic biases, and tactical shifts;

cash flows, and liquidity of the underlying funds (notice period for redemption);

frictional costs (spread on fund dealing, forward pricing, spread on underlying securities, redemption fees, premium or discount on traded funds, commissions);

and illiquid security constraints (side pockets and side cars).

In addition managers have the subjective influences to cope with - there will be anchoring to the selections made previously, both by strategy and by manager. There are relationships with managers to maintain, and not a single hedge fund manager likes receiving redemption notices, even if they are described to the fund manager by the investor as "rebalancing" or "just trimming an overweight". One investor I know told me that when he tried to diversify away from his very large holding in Soros' Quantum Fund by recycling just some of his gains in the fund, Soros told him it was all or none. He could take it all out or leave it all in but could not limit his exposure at the margin.This is where rationality meets a business man overseeing a business, and it is not seen as constructive in any way by the latter.

Still and all, the fund of funds managers have to manage. In former times, when positive fund flows extended to funds of funds as well as single manager hedge funds, the job of strategy/fund allocation was a lot more simple. The new inflows could be directed to the currently preferred funds and those that were being de-emphasised could be diluted down without any need for redemption notices. That all stopped in mid 2008. Since then strategy allocation in funds of funds has required (for most funds of funds for most of the time) a redemption for every subscription. Given that there was a persistence of net redemptions as a businesss background for funds of funds well into this year it has been very challenging to activelly allocate to strategies and individual hedge funds since.

One of the advantages of the Listed (funds of) hedge funds is that they are closed-ended vehicles: the capital, if not permanent capital, is there for a finite medium-to-long-term period. This does not get over the need to redeem from one fund to subscribe to another, but at least for the Listed funds of hedge funds there has not been a wall of redemptions to cope with. And if market demand allows there may be tranches of new capital raised for quoted vehicles, to mimic the positive allocation/dilution tactic of open ended funds of funds that have positive flows.

The way that International Asset Management (IAM) has used this capacity to allocate to strategies is shown in the following table.

Strategy Allocation at Quarter End through 2010

3Q | 2Q | 1Q | 4Q’09 | |

Long/Short Equity | 30.7 | 27.4 | 38.2 | 35.4 |

Macro | 18.4 | 17.7 | 16.9 | 17.2 |

Credit | 11.4 | 9.5 | 9.2 | 8.3 |

Fixed Income Rel Val | 10.9 | 11.4 | 8.9 | 8.2 |

Event Driven | 10.3 | 11.9 | 9.5 | 12.1 |

Multi-Strategy | 9.4 | 10.3 | 6.9 | 6.9 |

Trend Followers / CTAs | 5.3 | 7.6 | 10.5 | 9.5 |

Cash & Receivables | 3.5 | 4.1 | -0.2 | 2.1 |

Fund of Funds | 0.1 | 0.1 | 0.1 | 0.3 |

Source: International Asset Management Limited

A couple of strategy shifts are clear from this time series. In early 2010 capital was taken from Event Driven funds and allocated to Long/Short Equity. After the first quarter CTAs and Equity managers were used as sources of capital for additions to weightings in Multi-Strategy, Credit and to raise cash.

Rather like the approach to hedge fund investing taken by the Common Fund in the U.S., it seems that IAM used a core/satellite approach to portfolio construction, as the Top 10 holdings in Alternative Investment Strategies Limited has been very stable over the last year. The funds listed at the latest data point are shown below.

The Top 10 Holdings as at 30 September

Cobalt Offshore | 5.82% |

IAM Trading Fund | 5.25 |

Claren Road Credit | 4.87 |

SCP Ocean | 4.86 |

Capula Global Relative Value | 4.72 |

Arrowgrass International | 4.71 |

WCG Offshore | 4.66 |

York European Opportunities | 4.64 |

Prologue | 4.41 |

Diamondback | 4.40 |

The funds are the same as at the start of the year with only one exception (highlighted). The Top 10 funds accounted for 48.34% of the capital at the three-quarter stage.

The Top 10 Holdings of Alternative Investment Strategies Limited as at 31st December 2009

Cobalt Offshore | 5.5% |

SCP Ocean | 4.75 |

IAM Trading Fund | 4.74 |

Plainfield | 4.62 |

York European Opportunities | 4.20 |

Capula Global Relative Value | 4.15 |

WCG Offshore | 4.13 |

Claren Road Credit | 4.11 |

Diamondback | 4.06 |

Prologue | 4.01 |

There is a continual battle in reality and in marketing pitches about the relative contribution of the top-down (strategy allocation) and bottom-up (manager selection) in funds of hedge funds. The long list of practical difficulties given here shows that specifically since mid-2008 funds of funds have had less degrees of freedom in both of those regards than they had previously enjoyed, and that though there may be disappointment over the returns from funds of hedge funds over that period, there are also generic reasons why they have been as limited as they have been. There are other reasons for the under-performance relative to hedge fund indices and hedge fund averages, but they can be explored at another time.

Footnote: The net asset value performance of Alternative Investment Strategies since inception in December 1996 to 30 September 2010 is 146.84%, equivalent to an annualised rate of 6.75%.

ADDITIONAL: UBP ON STRATEGY ALLOCATION (from their Outlook for 2011)

Larry Morgenthal, CIO of Alternative Investments at UBP Asset Management, believes that reports of the demise of hedge funds are premature. He is quite positive about the industry and believes hedge funds remain an attractive proposition: they provide diversification benefits and they have strong alpha generation potential.

With respect to the various hedge fund strategies, Larry Morgenthal goes on to say, "Allocating between hedge fund strategies is in some respects like dating - we have had a great relationship with credit, are having an affair with long-short equity and think that emerging markets could be marriage material, while macro is like an old flame - not large in the picture now but one we expect to get back together with in the future."

ADDITIONAL TWO: Send me some examples of funds of hedge funds strategy allocations (letters) and I will post a range of them here.

Saturday, 9 October 2010

Brevan Howard Adds Strategies to Increase Capacity

When you are Europe's largest hedge fund manager and run one of the world's largest hedge funds you are bound to run into constraints on the amount of capital you can run successfully. Brevan Howard Capital Management Limited has around $32 billion under management, and three-quarters of that is in the Brevan Howard Master Fund Ltd., a global macro and relative value fund focused on fixed-income and currency markets.

The only respect in which the BH Master Fund is concentrated is in the number of major decision makers running it. Alan Howard has the largest risk budget at the firm, and there are a small number of other senior risk takers - the trusted lieutenants of Howard who have worked with him and for him since the launch of the firm. This small cadre take most of the risk in the Fund. There have been few changes in the risk-taking leadership of the firm in either personnel or number. Alan Howard has to trust this macro and fixed income elite squad, and this trust is not earned quickly.

A consequence is that unless the style of investment changes, and/or the level of risk assumption across the team changes it is difficult for the Master Fund to take in new capital. Alan Howard has been explicit about this - he has had no intention of changing the scope or style of the Master Fund - so when he opened the Fund to new subscriptions last year it was for a short period and was soon over-subscribed.

For the firm to grow, Brevan Howard has to add new strategies either in the existing fund(s) or add new funds dedicated to new strategies. The Baker Street based macro mavens have decided to follow the latter route it was announced this week with this press release:

For those who can't quite place the name, Gorton is the former JP Morgan trader who was co-founder and is still co-Chief Executive of London Diversified Fund Management. London Diversified Fund Management ran the London Diversified Fund and the London Select Fund, using a style similar to that of former hedge fund giant Vega Asset Management in fixed income/macro. The eventual commercial outcomes of the LDFM funds were also similar to those of Vega. At the start of 2008 LDFM managed $5bn and today is thought to run somewhere North of $500m. It may be indicative that around $200m of those funds are in a managed account.

The Brevan Howard press release emphasises that the investment strategy to be utilised in the new fund are based on a "strictly quantitative approach". It is also important from the BH perspective that the new Fund utilises the Brevan Howard risk management and execution platform. Each trade and the overall risk profile of the portfolios can be monitored real-time by the BH risk professionals and compliance with the mandate can be verified readily. It is an interesting commercial arrangement in that a joint venture has been formed, and that David Gorton remains running an independent asset management entity, even if he has had to be additionally registered for FSA purposes at Brevan Howard.

Additional: This week Brevan Howard announced that they are set to float a new investment company – BH Credit Catalysts limited - on the London Stock Exchange in December. As the name suggests the Fund trades in the credit markets, and in this particular case with a bottom-up catalyst-driven credit trading style. The underlying Fund is advised by DW Investment Management, headed by David Warren, and has been running for over two years. The DWIM Team consists of 22 professionals based in New York.

David Warren joined Brevan Howard in January 2008 with a mandate to build a credit team. The team spun out from Brevan Howard in June 2009 and continues to use Brevan Howard’s infrastructure and risk management. DWIM’s credit team has a strong track record producing total return performance of +44% in the period from May 2008 to August 2010, a period characterised by some of the most volatile markets in recent history (2008-2010). Over this period the existing credit fund has been the best performing fund at Brevan Howard.

The Listing of the investment company does not necessarily increase capacity for new capital at Brevan Howard, but does allow for the creation of permanent capital for the money management firm, as this is a closed ended vehicle. What Alan Howard did not do is allow more capital into the BH Master Fund and then allocate from that to the Credit Catalyst Fund. This is an externally visible signal that confirms the confidence that Howard has in DWIM.

The only respect in which the BH Master Fund is concentrated is in the number of major decision makers running it. Alan Howard has the largest risk budget at the firm, and there are a small number of other senior risk takers - the trusted lieutenants of Howard who have worked with him and for him since the launch of the firm. This small cadre take most of the risk in the Fund. There have been few changes in the risk-taking leadership of the firm in either personnel or number. Alan Howard has to trust this macro and fixed income elite squad, and this trust is not earned quickly.

A consequence is that unless the style of investment changes, and/or the level of risk assumption across the team changes it is difficult for the Master Fund to take in new capital. Alan Howard has been explicit about this - he has had no intention of changing the scope or style of the Master Fund - so when he opened the Fund to new subscriptions last year it was for a short period and was soon over-subscribed.

For the firm to grow, Brevan Howard has to add new strategies either in the existing fund(s) or add new funds dedicated to new strategies. The Baker Street based macro mavens have decided to follow the latter route it was announced this week with this press release:

"David Gorton and Brevan Howard are pleased to announce the formation of a new joint venture, DG Systematic Trading LLP, to pursue systematic trading strategies. David Gorton is the Chief Investment Officer of the new venture with responsibility for the management and development of trading strategies based upon a suite of systematic models which have been running capital since May 2006 including capital allocated from Brevan Howard Master Fund since 1 March 2010.

DG Systematic Trading LLP will be FSA authorised and will act as investment manager of Brevan Howard Systematic Trading Fund, a systematic trading fund which utilises Brevan Howard's risk management and execution platform. Brevan Howard Systematic Trading Fund has been seeded with $300 million from Brevan Howard Master Fund and has been successfully traded by David Gorton and his team since 1 March 2010. For the period from 1 March to 30 September this strategy has delivered returns on allocated capital of 9.3% net of fees."

For those who can't quite place the name, Gorton is the former JP Morgan trader who was co-founder and is still co-Chief Executive of London Diversified Fund Management. London Diversified Fund Management ran the London Diversified Fund and the London Select Fund, using a style similar to that of former hedge fund giant Vega Asset Management in fixed income/macro. The eventual commercial outcomes of the LDFM funds were also similar to those of Vega. At the start of 2008 LDFM managed $5bn and today is thought to run somewhere North of $500m. It may be indicative that around $200m of those funds are in a managed account.

The Brevan Howard press release emphasises that the investment strategy to be utilised in the new fund are based on a "strictly quantitative approach". It is also important from the BH perspective that the new Fund utilises the Brevan Howard risk management and execution platform. Each trade and the overall risk profile of the portfolios can be monitored real-time by the BH risk professionals and compliance with the mandate can be verified readily. It is an interesting commercial arrangement in that a joint venture has been formed, and that David Gorton remains running an independent asset management entity, even if he has had to be additionally registered for FSA purposes at Brevan Howard.

Additional: This week Brevan Howard announced that they are set to float a new investment company – BH Credit Catalysts limited - on the London Stock Exchange in December. As the name suggests the Fund trades in the credit markets, and in this particular case with a bottom-up catalyst-driven credit trading style. The underlying Fund is advised by DW Investment Management, headed by David Warren, and has been running for over two years. The DWIM Team consists of 22 professionals based in New York.

David Warren joined Brevan Howard in January 2008 with a mandate to build a credit team. The team spun out from Brevan Howard in June 2009 and continues to use Brevan Howard’s infrastructure and risk management. DWIM’s credit team has a strong track record producing total return performance of +44% in the period from May 2008 to August 2010, a period characterised by some of the most volatile markets in recent history (2008-2010). Over this period the existing credit fund has been the best performing fund at Brevan Howard.

The Listing of the investment company does not necessarily increase capacity for new capital at Brevan Howard, but does allow for the creation of permanent capital for the money management firm, as this is a closed ended vehicle. What Alan Howard did not do is allow more capital into the BH Master Fund and then allocate from that to the Credit Catalyst Fund. This is an externally visible signal that confirms the confidence that Howard has in DWIM.

Thursday, 26 August 2010

Another Year Another Challenge for Funds of Funds

In 2008 the fund of funds industry had a tough time producing returns for investors because only 30% of hedge funds produced a positive return. For 2009 things were tough for funds of funds as they couldn't get out of the hedge funds that had let them down by making losses in 2008, because of limited liquidity in the funds, suspended redemptions, and sidecars. Further, few of the funds which made money in 2008 made good money in 2009. So if funds of hedge funds stayed loyal to their winners of 2008 it probably cost them in 2009. There was even a reversal of the size effect on hedge fund returns in moving from 2008 to 2009.

Before looking at hedge fund returns in 2010, and factors that will impact fund of funds returns, let's look at single manager hedge fund returns in 2008 and 2009 from an absolute and relative perspective.

2008 was an absolute disappointment in terms of hedge fund returns- a loss of around 16%. Last year hedge funds produced their best returns since 1997, at up 19%, by the Greenwich Global Hedge Fund Index. And year to date through July, the same hedge fund index has a small positive return (up 1%), which is not good in isolation as an absolute return over seven months.

The returns from equities put the absolute returns of hedge funds into some context. Using the S&P500 as a proxy for the equity asset class, the hedge fund returns of 2008-9 look very different. The S&P500 was down 38.5% in 2008, the year hedge funds at an index level lost 16% in a liquidity crisis with high volatility and fraud in the industry, and even so 30% of hedge funds were up.

In 2009 the S&P500 was up 23.5% and hedge funds were up 19%, which given the constrained directionality (beta to markets) is as good as it gets for the alternative funds. Over 70% of hedge funds produced positive returns in 2009.

This year the S&P is down 4.3% at the time of writing, whilst representative indices of hedge funds are up a small amount. However the context for hedge fund returns in 2010 is even tougher in some regards than the previous two years. To begin with, let's look at the trajectory of the equity market this year. Below is a one year chart of the S&P500.

|

| source:stockcharts.com |

The rally of the second half of 2009 actually peaked in the first few weeks of 2010, and thereafter the stock market has been a rollercoaster of epic proportions, meaning a serious of precipitous falls followed by sharp rises. Monthly index level changes of 7-8% have not been unusual since the outbreak of the Credit Crunch, but the sequences have changed: we had a string of big down months in the bear market to the low in March last year, then a series of big up moves in the massive rally of the last three quarters of last year. In 2010 we have had big up and big down moves alternately. Given that managing the net exposure is typically the biggest risk control variable of most hedge fund strategies (bar the market neutral strategies), this year has been amongst the most difficult market direction background I can recall, as the market was aggressively moving one way and then the other by turns.

Persistence of market movement, or propensity to trend, is different from volatility in traded markets. It turns out that the actual volatility of the S&P500 index, as a proxy for global equity markets, has been both unusually low and then high this year. The chart below shows 30-day historic or actual volatility of the S&P500.

|

| source: Bloomberg LLP |

A level above 25% historic volatility (as opposed to traded volatility) has been uncommon in equity markets, except for short periods, and except for the last two years. The shifts in volatility seen this year would probably have hurt more hedge fund strategies than they helped. Pure volatility strategies should have benefited from the April/May shift in volatility, and the delta hedging of CB arbitrage funds should have had a good background in March and after the June peak in volatility . Overall 51% of hedge funds by number had produced positive absolute returns at the half way point of the year. This hurdle was exceeded by 68% of hedge funds at the end of the first quarter of the year, so the year has got progressively tougher as it has gone on - that falling success rate persisted into the end of August

Hedge Fund Returns by Strategy

|

| source:Greenwich Alternative Investments |

Returns by strategy are for the most part marginally profitable or loss making this year. As this is the case, differences in index and sub-index construction and scope have produced different outcomes. What one index provider has as a strategy with a positive return, another shows a negative return for. Lipper's series of hedge fund strategy indices has only two strategies out of 13 given producing positive returns this year. Greenwich Global Hedge Fund Indices show only three strategies with negative returns in the YTD (out of a total of 15). Both index providers agree that Long/Short Credit and Convertble Bond Arbitrage are amongst the best strategies for returns so far this year.

Looking across other index providers (Dow Jones Credit Suisse, and Hedgefund.net) it looks as if a small majority of hedge fund indices for strategies produced positive returns in the first seven months of the year. This hit-rate for positive returns by strategy in combination with the dispersion of returns within the strategy has some interesting implications.

Dispersion of Hedge Fund Returns Within Strategies January-July 2010

Wednesday, 16 June 2010

After An Unusual Month

Listening to Hugh Willis of BlueBay Asset Management on a conference call on Monday I was struck that twice he mentioned that May was a very unusual month in markets. Indeed it was; and in equity markets it resulted in losses of 8% (SPX) to 10% (MSCI Emerging Markets). Willis noted that such monthly losses had occurred only 5 or 6 times in his career.

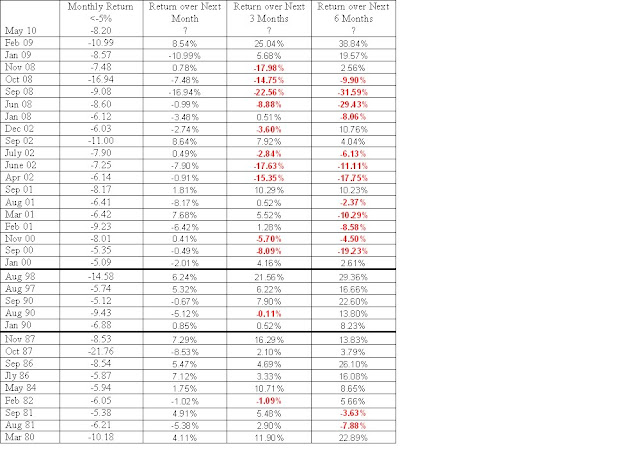

So how infrequent are such losses? To find out I looked at the S&P over the last three decades. There were 34 months for which the monthly loss was 5% or greater. Below is table showing all these losing months.

Monthly Losses of 5% or More on the S&P500 Index from 1980 and Onwards

(Note that the great bull market started in August 1982)

A few observations:

• There is increased clustering through time and far more observations of big losses in the neutral decade of the Noughties compared to the bull decades of the ‘80s and ‘90s.

• The frequency of subsequent 1 month positive returns was lower post-2000 than in the great bull market.

• For longer holding periods after a fall of 5% or more in stocks in a single month the outcomes have been distinctly worse in the Noughties than in the bull market decades. Holding stocks for a month or up to a couple of quarters after a 5% fall in stocks would tend to make you money in the ‘80s and ‘90s and lose you money in the last ten years or so.

• As a mechanistic strategy, buying for a month after a 5% fall in markets would have cost you money in the Noughties.

• As a mechanistic strategy, buying stocks after a monthly 5% fall in markets and holding for a quarter or two quarters would have cost you money in the Noughties, and made a ton of money in the ‘80s and ‘90s.

So how infrequent are such losses? To find out I looked at the S&P over the last three decades. There were 34 months for which the monthly loss was 5% or greater. Below is table showing all these losing months.

Monthly Losses of 5% or More on the S&P500 Index from 1980 and Onwards

(Note that the great bull market started in August 1982)

A few observations:

• There is increased clustering through time and far more observations of big losses in the neutral decade of the Noughties compared to the bull decades of the ‘80s and ‘90s.

• The frequency of subsequent 1 month positive returns was lower post-2000 than in the great bull market.

• For longer holding periods after a fall of 5% or more in stocks in a single month the outcomes have been distinctly worse in the Noughties than in the bull market decades. Holding stocks for a month or up to a couple of quarters after a 5% fall in stocks would tend to make you money in the ‘80s and ‘90s and lose you money in the last ten years or so.

• As a mechanistic strategy, buying for a month after a 5% fall in markets would have cost you money in the Noughties.

• As a mechanistic strategy, buying stocks after a monthly 5% fall in markets and holding for a quarter or two quarters would have cost you money in the Noughties, and made a ton of money in the ‘80s and ‘90s.

Wednesday, 26 May 2010

One Step Beyond for Lipper on Hedge Funds

We are well used to output from Thomson Reuters reporting on factual stories on the hedge fund industry. Through the Lipper subsidiary they are going a step further. Up to this point Global Head of Hedge Fund Research Aureliano Gentilini has published research looking backwards. He has gone from exhaustive analysis on dispersions of hedge fund returns and returns by strategy to something altogether less certain – forecasting.

What he has produced is the kind of output you see from funds of funds managers as they describe the macro environment and how it may suit/hurt the returns from the various hedge fund strategies.

Here are some edited extracts from Lipper Hedge Funds Insight Report, “Hedge Funds Outlook”, May 2010

The global macro-scenario, macro-information flow arrival, and volatility clustering are expected to continue dominating market sentiment in the short run.

In the current trading environment macro and systematic traders are expected to benefit the most from trading across diverse asset classes.

Looking at the recent past, historical patterns occurring in 2007 might materialize again. Several macro-driven "crowded trades" are about to appear again in hedge portfolios.

Concerns about absorption of new government bond issuance of PIIGS countries and low bid-to-cover ratios at government debt auctions will affect the intermediate-to-long sector of the yield curve in those countries.

The Dedicated Short-Bias strategy will be a bright spot as market fears resume. The ten-day exponential moving average of the CBOE Equity Put/Call Ratio—a gauge of the sentiment of speculative traders, which hit a multi-year record low of 0.472 on April 15—appears to be close to a reversal to the downside.

FX strategies will continue offering attractive opportunities to lock in profits in the short term. Of interest is the change in positioning that large speculators executed in the euro foreign exchange futures markets in the week ending May 18.

In the current market scenario gold and the U.S. dollar are expected to again trend higher in tandem, with the precious metal trending to record highs after a temporary pause.

What he has produced is the kind of output you see from funds of funds managers as they describe the macro environment and how it may suit/hurt the returns from the various hedge fund strategies.

Here are some edited extracts from Lipper Hedge Funds Insight Report, “Hedge Funds Outlook”, May 2010

Selected hedge fund strategies are expected to successfully navigate current market turmoil as the risk/return profile of hedge fund managers remains intact

The global macro-scenario, macro-information flow arrival, and volatility clustering are expected to continue dominating market sentiment in the short run.

In the current trading environment macro and systematic traders are expected to benefit the most from trading across diverse asset classes.

Looking at the recent past, historical patterns occurring in 2007 might materialize again. Several macro-driven "crowded trades" are about to appear again in hedge portfolios.

Concerns about absorption of new government bond issuance of PIIGS countries and low bid-to-cover ratios at government debt auctions will affect the intermediate-to-long sector of the yield curve in those countries.

The Dedicated Short-Bias strategy will be a bright spot as market fears resume. The ten-day exponential moving average of the CBOE Equity Put/Call Ratio—a gauge of the sentiment of speculative traders, which hit a multi-year record low of 0.472 on April 15—appears to be close to a reversal to the downside.

FX strategies will continue offering attractive opportunities to lock in profits in the short term. Of interest is the change in positioning that large speculators executed in the euro foreign exchange futures markets in the week ending May 18.

In the current market scenario gold and the U.S. dollar are expected to again trend higher in tandem, with the precious metal trending to record highs after a temporary pause.

Monday, 10 May 2010

Rate of Inflows to Hedge Fund Industry Fail to Accelerate in 2010

TrimTabs Investment Research and BarclayHedge reported that the hedge fund industry posted an estimated inflow of $7.6 billion, or 0.5% of assets, in March 2010. The firms estimate that hedge fund assets stand at a 16-month high of $1.64 trillion. Hedge fund third-party marketers have not seen much of these flows - they say that they have seen subscriptions static or even slightly lower than at the end of last year.

It could be that these statements are not incompatible: much of the net inflows to date have been to large well-established funds who do not feel the need to use 3PMs. The external marketers will see their share of flows when the scale of flows pick up further, and when industry flows broaden out across the strategies, and broaden across the maturity and scale range seen in the industry.

In terms of strategies in receipt of these flows the trends of last year have continued: Event Driven funds have done best, having had an inflow in March equivalent to 1.5% of assets, on the back of industry leading returns of 6.6% in the first four months of the year. The largest outflows from an investment strategy in March 2010 were from the Multi-Strategy Funds – a strategy that had net outflows through last year.

Industry Level Net Flows Per Month

Inflows in November 2009 $18.7bn

Inflows in December 2009 -$3.8bn

Inflows in January 2010 $7.1bn

Inflows in February 2010 $16.6bn

Inflows in March 2010 $7.6bn

Source: TrimTabs Investment Research and BarclayHedge

The flows at the industry level are unlikely to pick up in the next few months given the gyrations in the markets for traditional assets. Collective memory of falling markets is still strong at this point, only just over a year on from the market lows. The level of traded equity volatility has doubled in the last few weeks, and price levels in FX, commodities, equities and bonds have shifted quickly enough that the perceptions are that the markets are trading more emotionally. This is not the background against which most institutional investors can devote senior management time to making active decisions about allocations to hedge fund strategies, and still less about allocations to individual hedge fund managers.

Subscribe to:

Posts (Atom)