Listening to Hugh Willis of BlueBay Asset Management on a conference call on Monday I was struck that twice he mentioned that May was a very unusual month in markets. Indeed it was; and in equity markets it resulted in losses of 8% (SPX) to 10% (MSCI Emerging Markets). Willis noted that such monthly losses had occurred only 5 or 6 times in his career.

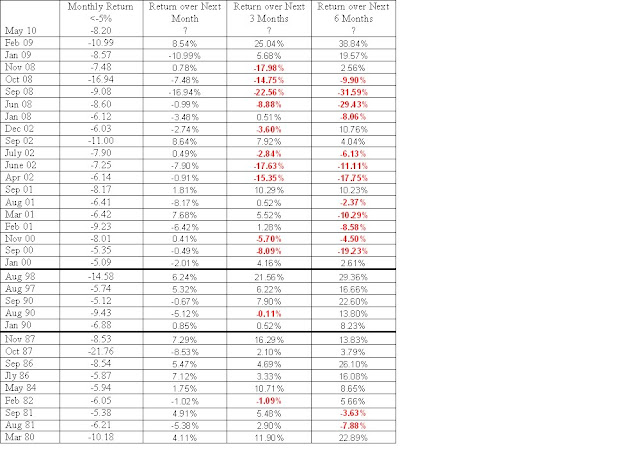

So how infrequent are such losses? To find out I looked at the S&P over the last three decades. There were 34 months for which the monthly loss was 5% or greater. Below is table showing all these losing months.

Monthly Losses of 5% or More on the S&P500 Index from 1980 and Onwards

(Note that the great bull market started in August 1982)

A few observations:

• There is increased clustering through time and far more observations of big losses in the neutral decade of the Noughties compared to the bull decades of the ‘80s and ‘90s.

• The frequency of subsequent 1 month positive returns was lower post-2000 than in the great bull market.

• For longer holding periods after a fall of 5% or more in stocks in a single month the outcomes have been distinctly worse in the Noughties than in the bull market decades. Holding stocks for a month or up to a couple of quarters after a 5% fall in stocks would tend to make you money in the ‘80s and ‘90s and lose you money in the last ten years or so.

• As a mechanistic strategy, buying for a month after a 5% fall in markets would have cost you money in the Noughties.

• As a mechanistic strategy, buying stocks after a monthly 5% fall in markets and holding for a quarter or two quarters would have cost you money in the Noughties, and made a ton of money in the ‘80s and ‘90s.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment