From today's "CityAM" newspaper:

"ALAN Howard, the hedge fund entrepreneur and Conservative Party donor, has quit the country to live and work in Switzerland. The co-founder of Brevan Howard Asset Management, one of Europe’s largest hedge funds, joins two other fund managers in the company’s Geneva office as part of a bigger exodus out of the City.

The firm acquired offices in Switzerland with capacity for 40 employees in February. It has said previously it has no plans to move its entire London operations elsewhere. The hedge fund’s listed company BH Macro said in a statement to the stock exchange that Howard “continues in his role as the principal risk taker” for company investments.

Howard has a personal fortune of £875m, according to The Sunday Times, and already owns a home in Switzerland.

BlueCrest, another hedge fund, expects as many as 70 of its 350 staff to be based in Geneva by next year. Chief executive Michael Platt said in April: "The establishment of the Geneva office...will enhance the group's ability to recruit and retain the best talent in our industry.”"

It will not necessarily be possible to generalise from this example and say that the exodus of hedge fund managers from London willl become a major trend for several reasons. Just take Alan Howard to begin with.

He may or may not be worth £875m, but whatever his net worth it runs into hundreds of millions of pounds. Howard has the largest stake in Europe's largest hedge fund group. So changes to the capital gains tax regime in the UK may have a significant impact on his retaining his existing wealth.

The number of managers generating as much wealth through income each tax year is very limited. So Alan Howard is atypical for the sheer size of his annual earnings. The Brevan Howard main man is also an extreme example in part because he has made money each year. Many managers have not had to pay much tax at all on earnings in 2008, as they received only management fees and not performance fees. Although the majority of managers are through their high water marks by now, most of them have not moved their NAVs significantly on from that break-even level for profits. So they have limited incentive to move now.

A third element to point out is that Alan Howard has the distinct advantage of having a house in Switzerland, indicating a degree of comfort and familiarity with living in the country. These advantages will not be available and be felt by many other hedge fund managers.

Addition of 2nd August

Alan Howard is to be joined in Switzerland by a former colleague. Jean-Philippe Blochet was a fellow founder of Brevan Howard and now works for Moore Capital Management. Blochet is to move to the new Zurich office of Moore Capital where he will work alongside Kornelius Klobuchar, who has also relocated from London. According to Bloomberg the firm is expected to hire further staff, and to move additional London-based personnel.

Griffin Capital Management, which moved its main investment office to Gibraltar from London, opened an office in Zurich in May this year.

Wednesday, 30 June 2010

Wednesday, 16 June 2010

After An Unusual Month

Listening to Hugh Willis of BlueBay Asset Management on a conference call on Monday I was struck that twice he mentioned that May was a very unusual month in markets. Indeed it was; and in equity markets it resulted in losses of 8% (SPX) to 10% (MSCI Emerging Markets). Willis noted that such monthly losses had occurred only 5 or 6 times in his career.

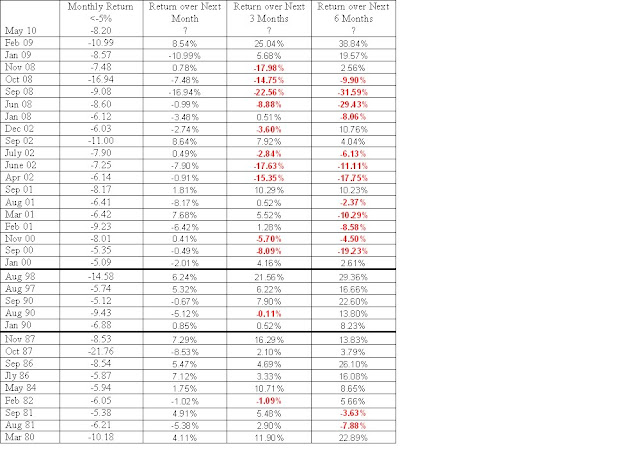

So how infrequent are such losses? To find out I looked at the S&P over the last three decades. There were 34 months for which the monthly loss was 5% or greater. Below is table showing all these losing months.

Monthly Losses of 5% or More on the S&P500 Index from 1980 and Onwards

(Note that the great bull market started in August 1982)

A few observations:

• There is increased clustering through time and far more observations of big losses in the neutral decade of the Noughties compared to the bull decades of the ‘80s and ‘90s.

• The frequency of subsequent 1 month positive returns was lower post-2000 than in the great bull market.

• For longer holding periods after a fall of 5% or more in stocks in a single month the outcomes have been distinctly worse in the Noughties than in the bull market decades. Holding stocks for a month or up to a couple of quarters after a 5% fall in stocks would tend to make you money in the ‘80s and ‘90s and lose you money in the last ten years or so.

• As a mechanistic strategy, buying for a month after a 5% fall in markets would have cost you money in the Noughties.

• As a mechanistic strategy, buying stocks after a monthly 5% fall in markets and holding for a quarter or two quarters would have cost you money in the Noughties, and made a ton of money in the ‘80s and ‘90s.

So how infrequent are such losses? To find out I looked at the S&P over the last three decades. There were 34 months for which the monthly loss was 5% or greater. Below is table showing all these losing months.

Monthly Losses of 5% or More on the S&P500 Index from 1980 and Onwards

(Note that the great bull market started in August 1982)

A few observations:

• There is increased clustering through time and far more observations of big losses in the neutral decade of the Noughties compared to the bull decades of the ‘80s and ‘90s.

• The frequency of subsequent 1 month positive returns was lower post-2000 than in the great bull market.

• For longer holding periods after a fall of 5% or more in stocks in a single month the outcomes have been distinctly worse in the Noughties than in the bull market decades. Holding stocks for a month or up to a couple of quarters after a 5% fall in stocks would tend to make you money in the ‘80s and ‘90s and lose you money in the last ten years or so.

• As a mechanistic strategy, buying for a month after a 5% fall in markets would have cost you money in the Noughties.

• As a mechanistic strategy, buying stocks after a monthly 5% fall in markets and holding for a quarter or two quarters would have cost you money in the Noughties, and made a ton of money in the ‘80s and ‘90s.

Tuesday, 8 June 2010

April saw Outflows - Negative Data Revisions Caused by Funds of Funds?

A month ago when I reported on industry fund flows I wrote:

"The flows at the industry level are unlikely to pick up in the next few months given the gyrations in the markets for traditional assets. Collective memory of falling markets is still strong at this point, only just over a year on from the market lows. The level of traded equity volatility has doubled in the last few weeks, and price levels in FX, commodities, equities and bonds have shifted quickly enough that the perceptions are that the markets are trading more emotionally. This is not the background against which most institutional investors can devote senior management time to making active decisions about allocations to hedge fund strategies, and still less about allocations to individual hedge fund managers."

My expectations were met in April, as TrimTabs Investment Research and BarclayHedge reported that the hedge fund industry posted an estimated outflow of $3.5bn in that month.

Industry Level Net Flows Per Month

Source: TrimTabs Investment Research and BarclayHedge

TrimTabs and Barclayhedge also reported that the April flows "were the third outflow in five months". This was not how the flows data were reported month by month - the table above gives the flows as originally reported in each month, and April was the first negative flow of the year for the industry. This suggests that the early estimates of (positive) flows were not backed up by the subsequent data reported to databases.

All hedge fund databases get a similar experience - the early reporting funds are usually those with better numbers to report. Also funds of hedge funds report to databases with a lag to single managers. The negative flows could be concentrated in the multi-manager hedge funds, which would be consistent with barely a month of positive inflows to funds of funds (in aggregate) since the middle of 2008.

So positive flows, such as there have been, have been concentrated in single manager hedge funds, and funds of hedge funds as a whole continue to have difficulty attracting net new assets.

"The flows at the industry level are unlikely to pick up in the next few months given the gyrations in the markets for traditional assets. Collective memory of falling markets is still strong at this point, only just over a year on from the market lows. The level of traded equity volatility has doubled in the last few weeks, and price levels in FX, commodities, equities and bonds have shifted quickly enough that the perceptions are that the markets are trading more emotionally. This is not the background against which most institutional investors can devote senior management time to making active decisions about allocations to hedge fund strategies, and still less about allocations to individual hedge fund managers."

My expectations were met in April, as TrimTabs Investment Research and BarclayHedge reported that the hedge fund industry posted an estimated outflow of $3.5bn in that month.

Industry Level Net Flows Per Month

Inflows in November 2009 $18.7bn

Inflows in December 2009 -$3.8bn

Inflows in January 2010 $7.1bn

Inflows in February 2010 $16.6bn

Inflows in March 2010 $7.6bn

Inflows in April 2010 -$3.5bn

Source: TrimTabs Investment Research and BarclayHedge

TrimTabs and Barclayhedge also reported that the April flows "were the third outflow in five months". This was not how the flows data were reported month by month - the table above gives the flows as originally reported in each month, and April was the first negative flow of the year for the industry. This suggests that the early estimates of (positive) flows were not backed up by the subsequent data reported to databases.

All hedge fund databases get a similar experience - the early reporting funds are usually those with better numbers to report. Also funds of hedge funds report to databases with a lag to single managers. The negative flows could be concentrated in the multi-manager hedge funds, which would be consistent with barely a month of positive inflows to funds of funds (in aggregate) since the middle of 2008.

So positive flows, such as there have been, have been concentrated in single manager hedge funds, and funds of hedge funds as a whole continue to have difficulty attracting net new assets.

Monday, 7 June 2010

Hedge Fund Takeovers - Martin Currie and Schroders Acquire

One of the themes I have written about for 2010 is that of M&A in the hedge fund business. The latest example is that of Martin Currie, the Scotland-based manager, taking over the Sofaer Capital European long/short equity business. So this deal is not for the whole of Sofaer's hedge fund business, just the European equity part of it, and no price details have been disclosed.

Citywire report that Martin Currie Investment Management has agreed to acquire the $280 million (£190.6 million) Sofaer Capital European long/short equity business as of July 1.

The two principals in charge of the fund, Michael Browne and Steve Frost, will move to Martin Currie and continue to run the $140 million vehicle. The pair has worked together on European equities for more than 20 years and began to co-manage the Sofaer Capital European hedge fund, which has delivered an annualised return of 8% versus -0.6% by the MSCI European benchmark, in January 2001.

Addidtion:

Subsequent to this posting Schroders has acquired a 49% interest in RWC Partners, a London-based hedge fund management firm. At the date of completion of the transaction, RWC had gross business assets of approximately £10 million and its total assets under management are just over €2 billion.

There are a couple of points of interest in this. Schroders acquired a minority, and have no formal agreement in place to acquire the balance of RWC Partners. This suggests that the sellers were negociating from a strong position.

The other point of interest is that the two fund managers of Schroders Income Fund (the top performing income over 3 years) who recently resigned from Schroder Investment Management were to join RWC in August! The managers concerned, Nick Purves and Ian Lance, were given the opportunity to veto the deal between RWC and Schroders, but declined to do so.

The momentum at RWC has been maintained by the addition of a team to run absolute return and currency funds - Peter Allwright and Stuart Frost will join from Threadneedle, where they ran the £2bn Threadneedle Absolute Return Fund. The pair have experience running global and European bond funds, so it is natural to expect more bond products to follow.

Citywire report that Martin Currie Investment Management has agreed to acquire the $280 million (£190.6 million) Sofaer Capital European long/short equity business as of July 1.

The two principals in charge of the fund, Michael Browne and Steve Frost, will move to Martin Currie and continue to run the $140 million vehicle. The pair has worked together on European equities for more than 20 years and began to co-manage the Sofaer Capital European hedge fund, which has delivered an annualised return of 8% versus -0.6% by the MSCI European benchmark, in January 2001.

Addidtion:

Subsequent to this posting Schroders has acquired a 49% interest in RWC Partners, a London-based hedge fund management firm. At the date of completion of the transaction, RWC had gross business assets of approximately £10 million and its total assets under management are just over €2 billion.

There are a couple of points of interest in this. Schroders acquired a minority, and have no formal agreement in place to acquire the balance of RWC Partners. This suggests that the sellers were negociating from a strong position.

The other point of interest is that the two fund managers of Schroders Income Fund (the top performing income over 3 years) who recently resigned from Schroder Investment Management were to join RWC in August! The managers concerned, Nick Purves and Ian Lance, were given the opportunity to veto the deal between RWC and Schroders, but declined to do so.

The momentum at RWC has been maintained by the addition of a team to run absolute return and currency funds - Peter Allwright and Stuart Frost will join from Threadneedle, where they ran the £2bn Threadneedle Absolute Return Fund. The pair have experience running global and European bond funds, so it is natural to expect more bond products to follow.

Wednesday, 2 June 2010

Rough May and YTD for Domestic Equity Hedge Funds

Equity markets have been a switchback this year – a series of rises and troughs like a sinewave. The markets had a normal interim correction after a good start to January. The correction took equity markets down nearly 10% at the low in early February, and then we had a rally of above-average strength – a gain of nearly 17% in two-and-a-half months.

The Euro and commodity inspired fall since the start of May has been very aggressive to the downside. As is typically seen, volatility has risen with falling prices from as low as 5% on 10 day basis to over 30% currently. Share prices fell 8.2% in the calendar month.

At the aggregate level, looking at hedge fund indices as a proxy, and for equity hedge funds as a whole, the equity market background has been perfect to trap equity hedge fund managers. Hedgies tend to manage their balance sheet (net and gross) on the feedback their P&L gives them about their current positioning. As the P&L gets more positive the net fund exposure bias tends to be reinforced the same way, and vice versa.

Of course, some managers are skilled market-timers and they will add value for their investors by raising and cutting the net exposure to markets around turning points, or adding aggressively to exposures in trending markets. But such market timers are a rarity, and as there are over four thousand equity hedge funds in the United States it is fair to say that the typical hedge fund manager there will not have enjoyed this year’s markets because of the directional changes.

Hedge Fund Research of Chicago tracks equity hedge fund returns of domestic (US based managers) via a daily-priced investible hedge fund index. The HFRX Index for Equity Hedge Funds was up 1.29% from the end of 2009 to the end of April, compared to the S&P500 up 6.4% (ex dividends). So far so dull.

But May was extremely difficult for equity hedge funds on the back of rising net exposures – created because of a trending market from mid-February to mid-April. The HFRX Index for Equity Hedge Funds lost 3.4% in May, putting the year-to-date return at the hedge fund index level at minus 2.1%.

This is the index level return, around which there will be a particularly wide dispersion of performance delivered from individual hedge funds. So expect May 2010 returns from equity hedge dedicated to US markets to be anything from +2% to -7%. Emerging market equity hedge funds and those in Asia will have done worse than -3.4% on average in May. Ouch..

The Euro and commodity inspired fall since the start of May has been very aggressive to the downside. As is typically seen, volatility has risen with falling prices from as low as 5% on 10 day basis to over 30% currently. Share prices fell 8.2% in the calendar month.

At the aggregate level, looking at hedge fund indices as a proxy, and for equity hedge funds as a whole, the equity market background has been perfect to trap equity hedge fund managers. Hedgies tend to manage their balance sheet (net and gross) on the feedback their P&L gives them about their current positioning. As the P&L gets more positive the net fund exposure bias tends to be reinforced the same way, and vice versa.

Of course, some managers are skilled market-timers and they will add value for their investors by raising and cutting the net exposure to markets around turning points, or adding aggressively to exposures in trending markets. But such market timers are a rarity, and as there are over four thousand equity hedge funds in the United States it is fair to say that the typical hedge fund manager there will not have enjoyed this year’s markets because of the directional changes.

Hedge Fund Research of Chicago tracks equity hedge fund returns of domestic (US based managers) via a daily-priced investible hedge fund index. The HFRX Index for Equity Hedge Funds was up 1.29% from the end of 2009 to the end of April, compared to the S&P500 up 6.4% (ex dividends). So far so dull.

But May was extremely difficult for equity hedge funds on the back of rising net exposures – created because of a trending market from mid-February to mid-April. The HFRX Index for Equity Hedge Funds lost 3.4% in May, putting the year-to-date return at the hedge fund index level at minus 2.1%.

This is the index level return, around which there will be a particularly wide dispersion of performance delivered from individual hedge funds. So expect May 2010 returns from equity hedge dedicated to US markets to be anything from +2% to -7%. Emerging market equity hedge funds and those in Asia will have done worse than -3.4% on average in May. Ouch..

Subscribe to:

Comments (Atom)