Gross Exposure of London's 50 Largest Hedge Funds in October 2009

- There is a pronounced phenomena that fixed income funds (including credit L/S) need a larger gross to deliver alpha. Multi-strat funds typically have a fixed income sub-strategy.

- Global macro funds weren't particulalrly levered in October last year - maybe they were largely out of bonds?

- Interestingly, the classicly leveraged strategy of managed futures is unlevered according to the FSA's survey results.

- London's L/S equity funds had a smaller gross than their US counterparts in October.

Fund and Portfolio Liquidity of London's 50 Largest Hedge Funds

Average Margin Requirements for London's 50 Largest Hedge Funds

- These are first tier hedge fund management companies, so would not suffer first from changes to margining rules by prime brokers. So the stability of margin requirements shown in October 2008 is perhaps understandable for them alone. That the margin requirements went up subsequently even for the top tier hedge funds shows the (lack of) availability of credit in 2009.

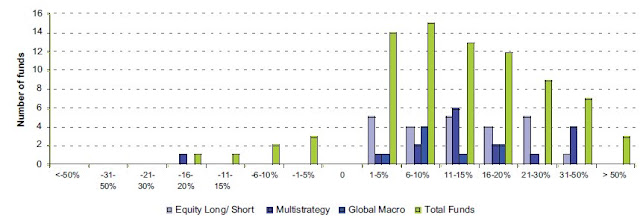

Distribution of Fund Returns of London's 50 Largest Hedge Funds in 6 Months to Oct 2009

- As much as anything else it is impressive how much the distribution of returns across the largest funds in the six months to October 2009 conforms to a (long) option-like payoff profile. Curtailing the downside and top-draw risk management is what investors in first tier funds expect and should get.

Change in Fund AUM of London's 50 Largest Hedge Funds over Six Months to October 2009

- All funds sufferred redemptions in the first half of 2009. The biggest and best funds had inflows in the second half of the year, but some London-based managers such as Lansdowne had excellent investment perfromance too. Those that performed well in 2009 had inflows and returns contributing to the growth in AUM.

Fund Total Number of Positions of London's 50 Largest Hedge Funds

- A few of the largest hedge funds in London have less than 50 positions in total.

- Most of the largest hedge funds managed from London, or where the fund management company if overseen by the FSA (like Moore Capital and Walter Capital, the SAC subsidiary), have 100-500 positions.

- Some of the multi-strategy funds engaged in statistical arbitrage or high frequency trading run portfolios with more than 5,000 positions. To put this in context there are around 3,000 different companies traded on the London Stock Exchange (excluding AIM).

source of all graphics: FSA

Also worthy of note is that the exposure of managers surveyed to European equities was a mere 0.9% of European market cap, suggesting that the influence of hedge funds on European equities is over-estimated and that the Directive is a disproportionate solution to the problem it is seeking to solve. Goodness, I can't even remmeber what that problem was anymore.

ReplyDelete